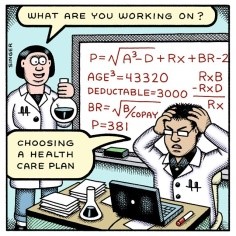

Choosing the right insurance plan for yourself or a

family member can be a daunting task, with hour’s online comparing plans that

look like complicated algebra problems.

As an Office Manager with TheraCORE Physical Therapy I have the

responsibility of verifying and explaining benefits to our patients before they

begin therapy. On a monthly basis, I am

confronted with patients that do not have a basic understanding of their health

insurance policy and its coverage. It’s

important to understand what you’re looking at before you choose the plan that

is best for you.

This

is where it’s useful to know a few health insurance vocabulary words. As the

consumer, your portion of costs consists of the deductible, copayments, and coinsurance.

Deductible: the amount of

money you must pay each year to cover eligible medical expenses before your

insurance policy starts paying. This amount is paid to the providers who have

rendered their services until the total deductible has been met.

Copayments: one of the

ways you share in your medical costs.

You pay a flat fee for certain medical expenses (e.g., $10 for every

visit to the doctor), while your insurance company pays the rest. With some

plans copayments apply towards the out-of-pocket maximums.

Coinsurance: the amount

you pay to share the cost of covered services after your deductible has been paid. The coinsurance rate is usually a

percentage. For example, if the

insurance company pays 80% of the claim, you pay 20%.

Out-of-pocket maximum: the most money you will pay during a year for

coverage. It includes deductibles, copayments,

and coinsurance, but is in addition to your regular premiums. Beyond this amount, the insurance company

will pay all expenses for the remainder of the year. Note: There are plans that

do not include the deductible in the out-of-pocket maximum; in this case your

total for a year would be your deductible + out-of-pocket maximum.

Premium: the amount you or your employer pays each

month in exchange for insurance coverage.

Phew!

Now that you understand the lingo, it’s time to decide what you and/or your

family needs from a health insurance plan:

A plan

that pays a higher portion of your medical costs, but has higher monthly

premiums, is better if:

·

You see a primary or specialist doctor frequently

·

You frequently need emergency care

·

You take expensive or brand-name medications on a

regular basis

·

You are expecting a baby, plan to have a baby, or

have small children

·

You’ve been recently diagnosed with a chronic condition

such as diabetes or cancer

·

You plan on having an extensive surgery that will

require months of rehab

A plan

with higher out-of-pocket costs and lower monthly premiums is the financially

smart choice if:

·

You can’t afford the higher monthly premiums for a

plan with lower out-of-pocket costs

·

You are in good health and rarely see a doctor

·

You do not currently take expensive or brand-name

medications on a regular basis

We’re

almost done! It’s time to see what your options are with your employer or

federal marketplace if you are self-insured.

Sometimes you may have the option to choose between a HMO and a PPO

plan. In the table below you will see a

comparison of HMO, and PPO insurance plans. This will help narrow down which

plan would best fit your healthcare needs:

|

Plan Type

|

Do you have to stay in network to get coverage?

|

Do procedures & specialists require a referral?

|

Best for you if:

|

|

HMO: Health Maintenance Organization

|

Yes, except for emergencies. This plan may be better if you

don’t mind your primary doctor choosing your specialists for you. If you have

not had a HMO insurance policy before, we suggest making a list of current

doctors you currently see and would like to continue to see. Check to see if they are affiliated with

the Health Maintenance Organization you are choosing before going with this

option.

|

Yes, Referral is required by your primary care doctor before

scheduling further appointments for tests, imaging, and specialists. Depending on the office, this process can

take 1-2 days to 1-2 weeks.

|

You want lower out-of-pocket costs and a primary doctor that

coordinates your care for you, including ordering tests and working with your

specialists.

|

|

PPO: Preferred Provider Organization

|

No, but in-network care is less expensive. Out of network care generally has a higher

deductible and out-of-pocket max. You

choose which doctors/specialists you see.

|

No

|

You want more provider options and no required referrals.

|

It is

important to look at your upcoming year and try to anticipate and plan for as

much as you can. Obviously accidents

happen and cannot be planned for, but understanding what you needed from a

health insurance plan in the past can help the decision making for your

future. Most health insurance plans

cover physical therapy, however coverage may be limited depending on the

carrier and plan you choose. For

example; some plans offer a 20 day maximum per calendar year, while others have

a third party company managing the disbursement and payment of physical therapy

benefits. If physical therapy is a

benefit you used in years past and feel that this may be something you will

need in the upcoming year, ask the carrier for an explanation of this benefit.

At TheraCORE,

we verify a patient’s therapy benefits before starting therapy. If you ever have a question regarding what

your therapy benefits are and would like one of our Office Managers to call and

check, please do not hesitate to call one of our offices. TheraCORE accepts most major insurance’s, and

offers affordable self-pay rates.

The federal marketplace

website offers snapshots of these costs for comparison, as do many state

marketplaces.

Amylynn Kucera

Office Manager

TheraCORE, Inc - Westmont, IL